Reports continue to come in from state agriculture departments, as well as cultivators, regarding final numbers for the 2020 growing season. The reports underscore the contraction that occurred in the hemp industry in 2020. We have noted previously that the amount of acreage licensed for hemp in the U.S. reached just over 400,000 in 2020, down by over 30% from roughly 590,000 acres licensed in 2019.

2020 CBD Hemp Production Down Significantly Year-Over-Year

Based on available information and the trends contained therein, we estimate that between 35% and 40% of acreage licensed for hemp was actually planted in 2020, or between 140,000 to 160,000 acres. If we assume 85% of all U.S. acreage was for CBD or other cannabinoid production, that amounts to between 119,000 and 136,000 planted acres devoted to CBD or other cannabinoid hemp. Our initial estimate for acreage planted with CBD or other cannabinoid hemp in 2020 is roughly half of our estimated planted acreage for 2019.

Definitive harvest data is very scarce at this point, but – taking into account available reports from market participants and regulators on successfully harvested acreage, the percentage of “hot” crops that tested over the 0.3% THC limit, and typical yields – our preliminary estimate for the amount of CBD and other cannabinoid hemp biomass produced in the U.S. in 2020 and marketable for extraction purposes is between roughly 50 million and 60 million pounds.

It is likely that actual production was higher, but we expect some successfully harvested cannabinoid biomass to go to waste due to low CBD potency, as well as handling and storage issues, particularly long-term storage difficulties due to a sluggish market. Our 2020 estimate of marketable biomass production is a bit over half that for 2019, which was 90 million to 112 million pounds.

Earlier Explosive Growth ‘Not Sustainable’

Brian Koontz is the Industrial Hemp Program Manager in Colorado, home of one of the oldest legal hemp programs in the U.S. While the national hemp market “exploded” in 2019, he told Hemp Benchmarks, 2020 showed that type of growth was not sustainable. “There was a significant market correction last year,” he said. “Other states, bigger producers like Oregon and Montana saw a 50% reduction in numbers, based on the fact that producers had surplus from [2019] and got hurt by the market.”

Jeff Greene, co-founder of the Florida Hemp Council, is also a lobbyist and business consultant. He thinks it will take several years before equilibrium is reached in the hemp sector. “The overabundance of biomass available [in 2020] tells me that while the farmers were ready, the industry wasn’t,” he told Hemp Benchmarks. “I think that we’re probably going to run through a year or two … where we’re going to see the pendulum swing from abundance to shortage of biomass.”

Accounts from other outlets illustrate the pendulum swings experienced so far in the short history of legal hemp. In Maine, the Portland Press Herald recently reported on the dramatic downsizing of the state’s industry. According to the report, 181 Maine farmers planted 2,081 acres of hemp in 2019. In 2020, 111 farmers obtained a license to grow only 211 acres of hemp in the state, with much of that apparently “never planted at all.”

The number of certified hemp growers in Nevada fell by nearly 50% from 2019 to 2020, according to state agriculture figures quoted by the Las Vegas Review-Journal. According to the data, there were 116 certified growers in the state last year, compared to 216 in 2019. Additionally, the amount of acreage planted fell by nearly 68% during that period, to about 1,600 acres last year.

2021 CBD Hemp Production Outlook Too Early to Tell

In our Hemp Spot Price Index Report for January we detail accounts from market participants and regulators of the early signs that they are seeing regarding whether production of CBD hemp will bounce back in 2021. More predictions for this year’s hemp growing season can also be found in a previous Hemp Market Insider report published last month.

Overall, it appears too early to say whether production of CBD and other cannabinoid hemp will expand, contract, or hold steady this year. On the one hand, a more stable hemp market is reportedly drawing increased interest from farmers.

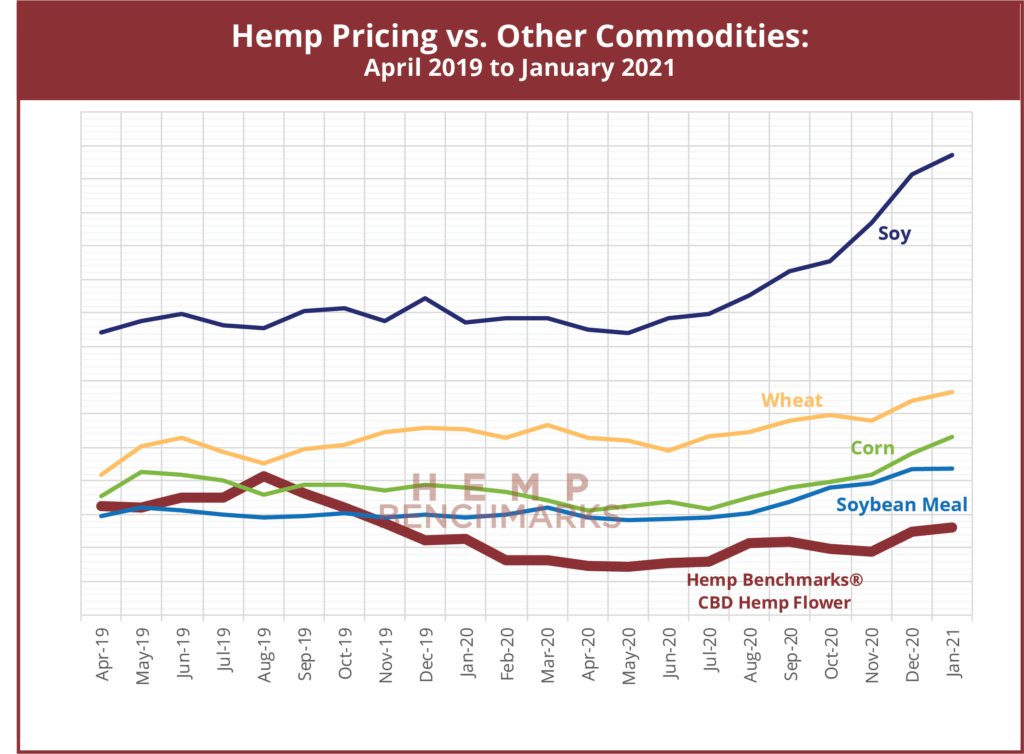

However, prices for traditional row crops like corn, soybeans, and wheat are currently at profitable levels for U.S. farmers, which could lead to increased planting of such staples and suppress the amount of acreage devoted to hemp this year. Additionally, some state agriculture departments relayed to Hemp Benchmarks that they expect the number of hemp production licenses issued in 2021 will decrease relative to last year.

Hemp Benchmarks will continue to survey state officials and market participants ahead of planting season in order to gauge the scope of hemp production in 2021, with findings published in our monthly Hemp Spot Price Index Reports.