November Price Commentary

After stabilizing in October, the aggregate assessed price for CBD Biomass experienced a rare uptick in November, with all volume brackets apart from the largest seeing rises this month. This jives with reports from market participants, documented below, who stated that they are seeing some higher prices on material harvested this year, compared to that left over from 2019’s crop.

On the other hand, the assessed price for CBG Biomass has cratered recently, dropping 44% this month after a 36% decline in October. Pricing for CBG extracts has been uneven. November saw the rate for CBG Distillate slide after a small increase last month, while the price for CBG Isolate jumped up by about $100 per kilogram after a big drop in October.

Prices or CBD extracts for the most part resumed their downward trend in November. Assessed rates for Crude CBD Oil and Refined CBD Oil – which encompasses various types of Distillates – both declined after stabilizing in recent months. A member of our Price Contributor Network – a large scale hemp-cannabinoid extractor in Colorado – reported this month that 60% of the company’s customers from last year have gone out of business, impacting demand for CBD and other cannabinoid extracts. However, they also noted that they are getting more requests for specific blended products, such as aqueous solutions and those blended with MCT (medium chain triglyceride) oils.

A notable observation from the reported transaction data is the increasing frequency of certified organic CBD extracts, both Distillates and Isolate. In regard to CBD Isolate, the only type of CBD extract to see a price rise this month, the increase was due to stability in rates for conventional product and more reported deals for higher-priced organic Isolate.

Smokable CBD Flower saw its assessed price decline, and for the second straight month. While one might expect the decrease to be due to increased supplies from this year’s crop, an analysis of our raw data indicates that this month’s downturn is largely because of the continued availability of low-priced product harvested in 2019. Indoor, greenhouse, and organic CBD Flower command significant premiums relative to older outdoor product.

Regarding more niche products, the average price for smokable CBG Flower was roughly equivalent with the assessed price for CBD Flower. However, based on our observations, it seems that sales frequency and volume of CBG Flower remains relatively low, although it is being advertised by sellers.

The average price of reported deals for delta-8 THC was $1,800 per kilogram this month, off by over $400 from last month. Observed transactions this month ranged from $1,300 to $2,600 per kilogram, compared to $1,400 to $3,200 per kilogram in October.

[Editor’s Note: The prices quoted above for smokable CBG Flower and delta-8 THC are raw transaction data and do not constitute official Hemp Benchmarks price assessments. Transaction data for such products is currently being vetted to meet Hemp Benchmarks methodology requirements, which include, but are not limited to, several months of statistically significant data and consistent or increasing transaction volume.]

November Report Contents

Price Commentary

CBD Biomass price experiences rare uptick on newly harvested material; Smokable CBD Flower price dips again; increased trading frequency of certified organic CBD extracts observed.

2020 Harvest Assessment

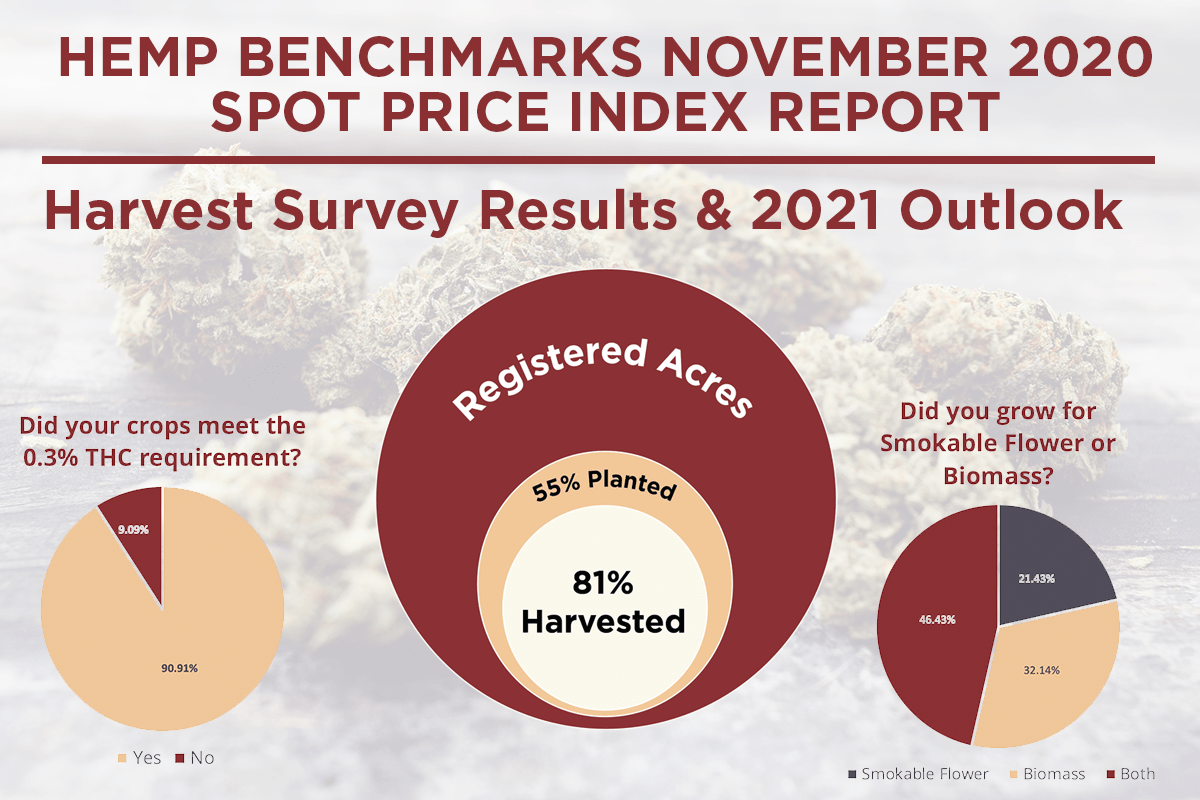

Definitive assessment of this year’s harvest is still hazy, but there is broad agreement that production contracted this year, while potentially significant portions of planted acreage were not harvested.

Market Reaction to 2020 Harvest Uncertain

Market participants are waiting to see how prices react to this year’s crop, as many are still dealing with biomass harvested in 2019.

Looking Ahead to 2021

Some CBD hemp growers are looking to lower production costs via mechanization; other market participants expect increased fiber production next year.

2020 Harvest Survey

Responses from a Hemp Benchmarks survey of growers circulated this month.

Transportation Update

Shipping costs generally lower in November, but pre-Christmas rush could lift prices to move goods through mid-December.

Federal Regulatory Updates

Senate committee calls on USDA to amend its Interim Final Rule; at least 20 states confirm that they will be staying with 2014 Farm Bill pilot programs in 2021

Industry Updates

Hemp Benchmarks examines the U.S. hemp grain market and hemp’s potential as animal feed.

State Updates

Reports from 18 states on 2020 experiences, 2021 plans; includes average THC test results from Indiana crops, new seed varieties certified by the Colorado Department of Agriculture.

International Updates

E.U court rules CBD is not a narcotic; Italy reverses previous ban on CBD; U.S. industry group receives funding from USDA toward development of export market.