Price Commentary

After observing substantial price declines virtually across the board since spring 2019, Hemp Benchmarks price assessments have in recent months shown stabilizing rates for numerous wholesale products that are part of the hemp-CBD supply chain. For example, from April through this month, the aggregate price for CBD Biomass has remained stable. Wholesale prices for smokable bulk CBD Flower have also steadied since April.

This month also saw prices tick upward for most forms of extracted CBD products covered in our reporting, with that for THC Free Distillate seeing the most notable increase. Whether this trend will hold is uncertain, given that many processors are reportedly sitting on significant amounts of inventory. Additionally, a member of our Price Contributor Network, a processor operating in Illinois, noted this month that large amounts of extracted CBD are currently “locked up” in bankruptcy reorganizations and lawsuits, and when such product might be released onto the market again is unknown.

While the downward trend in CBD product prices has largely subsided in recent months, that for CBG biomass and extracted forms of the cannabinoid has continued. However, smaller downturns were observed this month than in months prior, for the most part, although our assessed rate for CBG Distillate dropped in July.

Notably, this month is the first time that Hemp Benchmarks has observed the price for CBG Distillate settling lower than that for THC Free CBD Distillate. Due to demand for CBG being lower than that for CBD – combined with slowing sales of hemp products in general due in large part to COVID-19 – it appears quite possible that rates for CBG products could slip into line with, or below, those of their CBD counterparts in the future. However, July’s price for CBG Isolate remains over four times more than that for CBD Isolate, which has seen steep declines in recent months.

July 2020 Hemp Outlook:

2020 Production Outlook

Licensed production capacity down significantly from 2019. Page 8

Growing Season Update

Weather, pest issues hit Southern farmers. Page 9

How Are Businesses Navigating the Current Market?

Tight cash flows, shifting landscape present challenges. Page 10

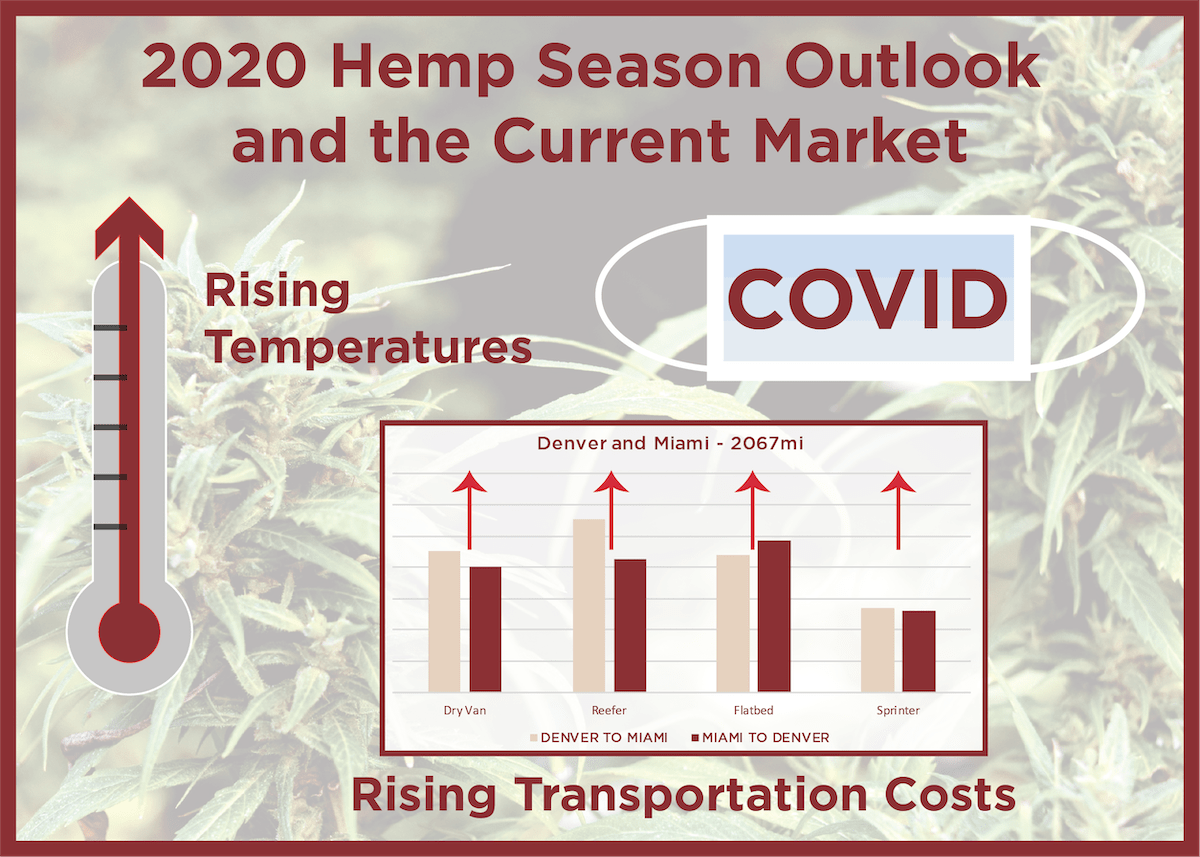

Hemp Transportation Costs Update

COVID-19 causing shipping costs to rise. Page 11

COVID-19 Latest

Pandemic generates increased uncertainty for sales, harvest. Page 13

Weather Outlook

CPC forecasts above-normal temperatures and precipitation for most of the U.S. in August, September, October period. Page 14

Industry Updates

Advocates petition for higher THC limit; industry groups consider national checkoff program. Page 14

Federal Regulatory Updates

Transition from 2014 pilot programs to 2018 Farm Bill plans could create complications during harvest season; USDA considering whether to include hemp in coronavirus relief program; FDA delivers CBD enforcement guidance to White House. Page 15

State Updates

Updates from several states detail percentages of crops being grown for CBD, fiber, grain; smokable hemp bans proliferate, but legal challenge in Indiana ongoing. Page 17

*New* International Updates

Ecuador legalizes hemp with up to 1% THC; EU officials suspend applications for CBD under Novel Food rules. Page 23