Official data published earlier this month put some hard numbers to what many have observed – the U.S. hemp industry is headed for its third straight year of contracting production and its smallest harvest since the crop was legalized federally in 2018. A tough market created initially by severe oversupply, then exacerbated in numerous ways by the COVID-19 pandemic and its attendant macroeconomic impacts, has driven many operators from hemp. Some, however, have persisted in the cannabinoid space, while data shows that the frequently-spoken about interest in hemp fiber has translated into some solid gains for this year.

The U.S. Department of Agriculture Farm Service Agency (USDA FSA) this month released its first batch of Crop Acreage Data for the 2022 Crop Year, which shows overall hemp production documented by the agency is down significantly from a year ago.

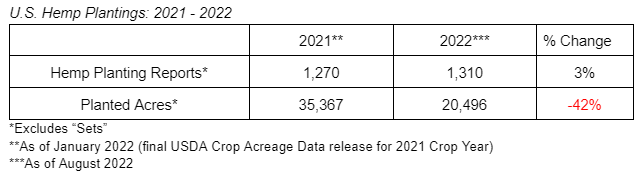

A Hemp Benchmarks analysis of the USDA FSA planted acreage figures reveals the following changes to the domestic hemp market’s production landscape this year:

Despite more farmers reporting their hemp plantings this year, overall acreage was down significantly from 2021. Furthermore, when data collected by Hemp Benchmarks directly from state agriculture officials for 2021 is combined with USDA planted acreage data, last year’s total, documented area planted with hemp approached 42,000 acres, indicating there has actually been more than a 50% decline in U.S. hemp production from 2021 to 2022.

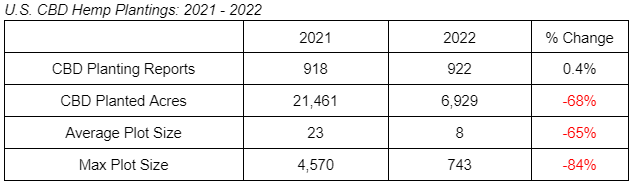

Unsurprisingly, contracting cannabinoid hemp production accounted for the bulk of the overall decline in acreage devoted to the crop in 2022. Although the number of farmers reporting planting cannabinoid hemp actually increased slightly, all other production metrics shown in the table above have seen dramatic downturns from a year ago, reflecting the tough conditions that have characterized the cannabinoid hemp market since shortly after the 2019 harvest.

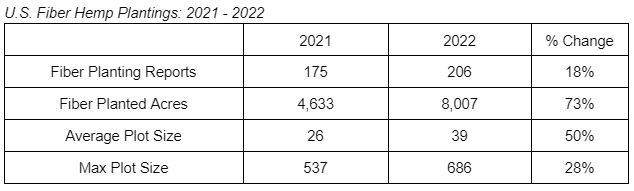

Fiber was the only type of hemp to see gains in 2022, with more farmers planting more acreage and significantly larger plots on average. While reports from market participants and regulators continue to tell of the need for more processing infrastructure to support this nascent sector, the increase in U.S. fiber hemp production indicates that existing and new processors have been able to establish themselves, expand capacity, and offer contracts to growers.

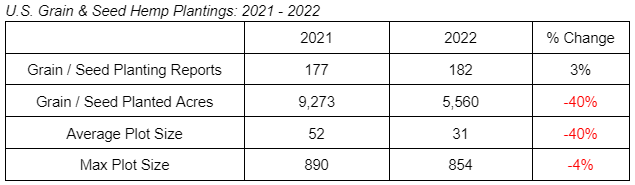

Reported plantings for hemp grain have seen significant contraction in 2022, with total planted acreage and average plot size both almost halved from the year before, even though a few more growers reported planting the crop. As we reported earlier this year, market participants told Hemp Benchmarks that high prices for staple crops such as corn, wheat, and soy have made it difficult for a niche specialty crop like grain hemp to get acres in farmers’ rotations.

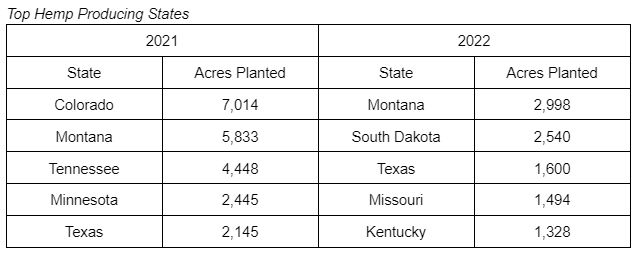

Below is a table showing the five states where farmers reported the most acreage planted with hemp for 2021 and 2022. The rankings are based on USDA FSA reports and data directly from state agriculture departments, where available.

It is important to note that the USDA FSA planting data is almost certainly incomplete, as those farming only hemp and no other traditional crops may not have reported their acreage to the agency. Still, the data provides one of the most full pictures available of U.S. hemp production. Additionally, even though production is down the number of farmers reporting increased overall, and in every category of hemp as well, indicating that efforts by USDA and state agriculture departments to encourage reporting were at least somewhat successful. Finally, while more Crop Acreage reports will be forthcoming for the 2022 crop year, 2021’s hemp planting data did not change dramatically from the beginning to the end of the crop year.

Related Articles:

- August 2022 Hemp Spot Price Index Report (August 31, 2022)

- Where Are Hemp Businesses Finding Success? (August 3, 2022)

- U.S. Hemp Grain Market Faces Headwinds from Bear Market, Ukraine War (July 6, 2022)

- Where Does the U.S. Hemp Industry Go From Here? (May 11, 2022)