In July, Hemp Benchmarks was able to acquire updated licensed acreage figures from nearly every state with a functional hemp program, providing some insight into how this year’s crop will compare to 2019’s. We have documented almost 400,000 acres of land in the U.S. registered for hemp production as of late July, along with over 63 million square feet of indoor or greenhouse space (about 1,450 acres).

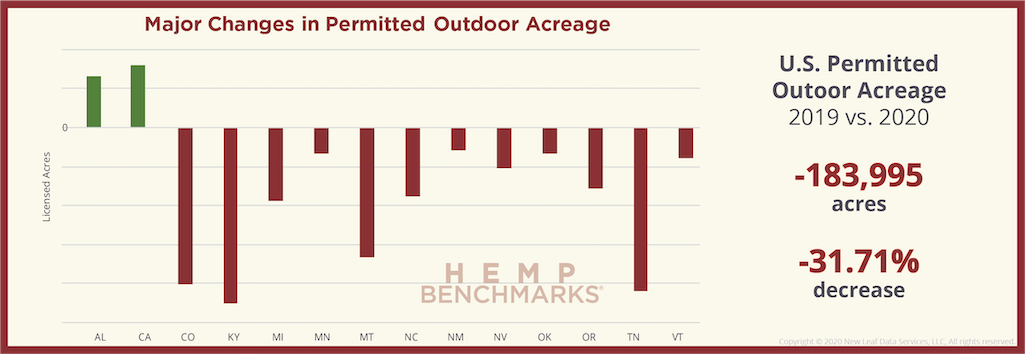

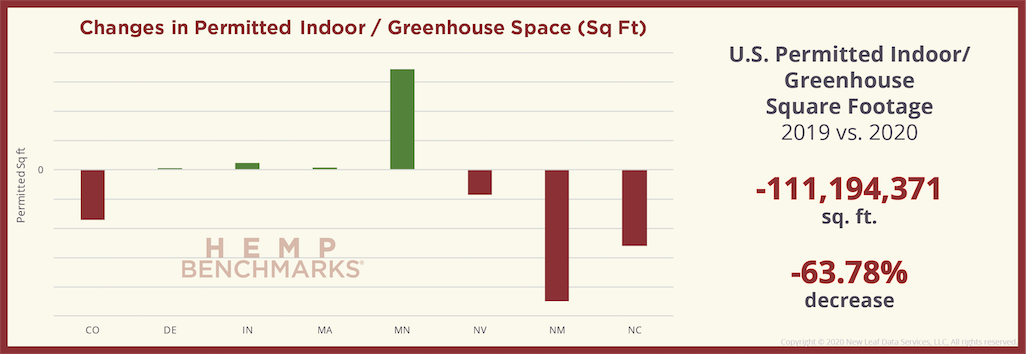

2020’s outdoor licensed acreage is off by over 30% from over 580,000 acres last year, while indoor and greenhouse square footage registered for hemp cultivation is down by roughly 64% year-over-year. These numbers bear out what we have reported earlier this year, that many farmers are taking a more conservative approach to cultivation, if not exiting the sector entirely.

The just over 18,000 cultivation licenses that we have counted nationwide to this point in 2020 represents about an 8% decline compared to the over 19,500 recorded in 2019. This indicates that most growers registered smaller outdoor plots or indoor / greenhouse sites. It should also be noted that many of those who farmed hemp in 2019 are not doing so in 2020, but most of those who exited appear to have been replaced by first-time growers, according to data and comments from state agriculture departments.

Of course, licensed acreage has not in the past translated into planted acreage. We have noted previously that we estimate that at least half of the acreage registered for hemp production in 2019 was not planted, a trend that appears as if it will continue this year.

Agriculture officials in numerous states told Hemp Benchmarks that they have similar expectations that a sizable portion of this year’s licensed acreage will go unplanted again. “My gut is telling me we won’t see nearly as much (outdoor) hemp planted in Arkansas as we did in 2019,” an official at the Arkansas Department of Agriculture stated in an email. “A lot of 2019 hemp growers have hemp sitting in storage unable to sell. I’m seeing a lot of return[ing] licensees holding back this season deciding not to plant at all / hold off until next season, and I’m seeing the newer licensees taking a stab at planting for the first time.”

Similarly, a spokesperson with the Florida Department of Agriculture & Consumer Services told Hemp Benchmarks that, “Of the 16,000 acres [registered as of June] we believe that perhaps 5,000 acres will actually be planted in 2020.” The official went on to state that they anticipate about 70% of the state’s crop will be farmed for CBD or other cannabinoids, with the remaining 30% devoted to fiber varieties.

As we have noted previously, a significant majority of U.S. hemp production this year will be for the purpose of CBD, as well as some minor cannabinoids, with CBG the most prominent among those. However, we estimate that the proportion of total U.S. production capacity devoted to CBD or other cannabinoid-rich hemp varieties will decline to roughly 75% this year, from around 90% in 2019.

Overall, the reduction in licensed acreage, entrance of a significant amount of new farmers, tough market conditions, and difficulties related to the COVID-19 pandemic, which we have been covering in our full Hemp Benchmarks Spot Price Index Reports, suggest that total U.S. hemp production for 2020 could decline substantially year-over-year, particularly in regard to how much CBD or other cannabinoid-rich biomass is generated. Whether a contraction in supply will result in more favorable commodity prices for farmers remains to be seen.