Hard data on planting and harvest rates from state agriculture departments remains sparse. Many of the agriculture departments contacted by Hemp Benchmarks say they are still tabulating their 2019 hemp production figures. Some states have yet to start officially monitoring hemp production in terms of acreage grown and harvested.

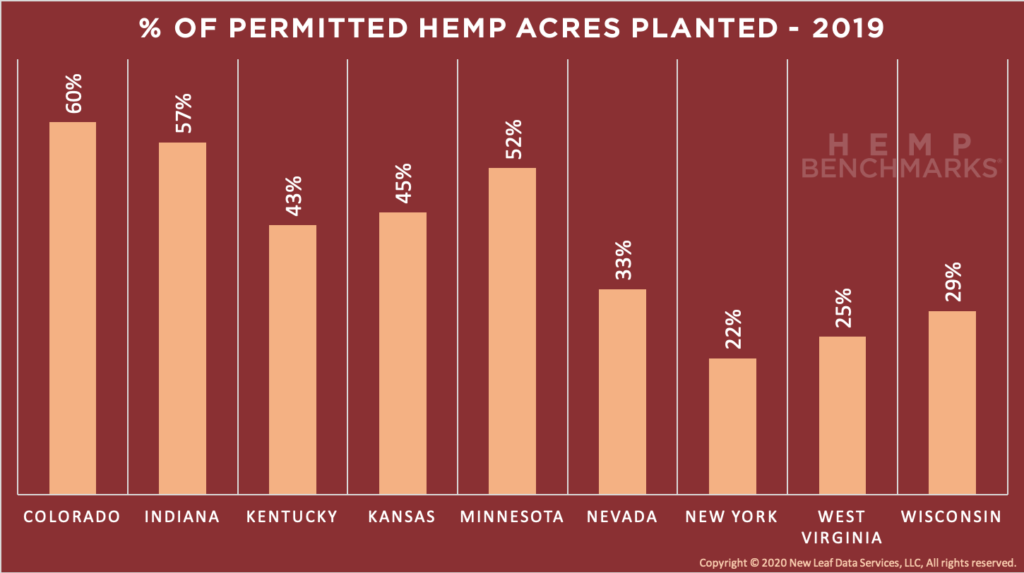

However, nine states provided information on planted acreage:

- Colorado: 52,275 acres planted (60% of amount licensed)

- Indiana: 3,000 acres planted (57% of amount licensed)

- Kentucky: 26,000 acres planted (43% of the amount licensed)

- Kansas: 2,600 acres planted (45% of amount licensed)

- Minnesota: 7,278 acres planted (52% of amount licensed)

- Nevada: 4,661 acres planted (33% of amount licensed)

- New York: 4,541 acres planted (22% of amount licensed)

- West Virginia: 641 acres planted (25% of amount licensed)

- Wisconsin: 5,000 acres planted (29% of amount licensed)

Six of the nine states that provided planting information to Hemp Benchmarks saw less than half of the acreage licensed for hemp production actually planted. Colorado and Kentucky are the only major hemp producing states among the group, with the former boasting the highest planting rate of the states that were able to provide data.

Definitive data on harvest rates is even more scarce, with only three states able to provide harvested acreage to Hemp Benchmarks by our publication deadline this month.

- Colorado: 51,851 acres harvested (99% of planted; 59% of licensed)

- Indiana: 1,600 acres harvested (53% of planted; 30% of licensed)

- Kansas: 1,427 acres harvested (55% of planted; 25% of licensed)

As we noted in our December 2019 report, Colorado officials qualified the high harvest rate, stating that some farmers had not yet reported, and they believed crop failure rates were higher. Anecdotal reports out of other major hemp-producing states suggests that crop failure was widespread even amongst experienced growers.

“We’re talking about a 30% pull,” one veteran cultivator in Oregon told Hemp Benchmarks, referring to the amount of hemp successfully harvested in his state. Most hemp farmers there, he said, lost up to 70% of their crops to “sun bake, late harvest, and mold issues.”

An Oregon-based processor with years of experience in both growing and processing, and who has recently expanded his work into Montana, told Hemp Benchmarks he was concerned about the amount of hemp he saw left in the fields in both states during late autumn and early winter.

The data that has been gathered by Hemp Benchmarks is not sufficient to prompt substantial revisions to our assumptions regarding the size of 2019’s hemp crop. Based on updated figures for licensed acreage received since our October report, however, we estimate that a bit under 90,000 acres of biomass were harvested and dried successfully from about 570,000 that were licensed, yielding roughly 90 million pounds of CBD-rich biomass suitable for extraction.

We will continue to attempt to refine our assessment of 2019’s crop, as being able to do so with some degree of certainty will be valuable to stakeholders attempting to size the market and evaluate supply-demand dynamics. As things stand, what can be said in regard to 2019’s production is that even with significant amounts of licensed acreage not planted, as well as large proportions of planted crops lost for various reasons, both before and after harvest, farmers generated enough CBD-rich biomass to overwhelm current processing capacity and create the glut that we have documented in recent months. If weather conditions had been more favorable, or harvesting and drying methods and equipment more efficient and effective, significantly more biomass suitable for extraction would have been brought in, exacerbating the current buyer’s market.